Medicare Part B and Part D Hidden Charges

Income-Related Monthly Adjustment Amount - IRMAA

The IRMAA penalty is an expense that MOST people do not plan for!

To have a sound retirement plan, budgeting for an IRMAA penalty is vitally important!

What is IRMAA? (Income-Related Monthly Adjustment Amount)

IRMAA is the additional premiums taxpayers are charged for their Medicare Part B and Part D premiums.

Part B covers non-hospital charges (doctor visits, lab work, etc.).

Part D is your prescription drug coverage.

Turning 65—when people turn 65 they will apply for Medicare. Premiums charged for the Part D and B coverage vary depending on your MAGI (Modified Adjusted Gross Income). The more you make, the more you pay!

If you are subject to the IRMAA penalty, how do you pay it? It’s automatically deducted from your Social Security check.

How much is the penalty? It depends on if you are married or single. The penalty (additional premium) can be anywhere from 70%-340% of the base Medicare premium.

How is the penalty calculated? It’s based on your last two years of MAGI this is a rolling two-year window with numbers recalculated every year!

Roth IRA conversion can cause an IRMAA penalty! Roth IRA conversions are very popular. However, since most many advisors are NOT familiar with IRMAA, when they run Roth IRA conversion numbers, they do not factor in whether the conversion will trigger an IMRAA penalty.

Will you have an “IRMAA Penalty”?

The biproduct of many (if not most) advisors (accountants, CPAs, EAs, financial planners, insurance agents, and estate planning attorneys) NOT being familiar with IRMAA is that many if not most consumers are not aware of IRMAA.

When you are not aware of a potential problem, you can’t plan to mitigate or avoid the problem.

Forecasting if you will have an IRMAA penalty is both easy and difficult. It’s easy to guess what your MAGI will be in retirement. But it becomes more complicated when you have to also forecast your future income tax brackets and future IRMAA income brackets.

With the right software (OnPointe), we can both forecast future income tax brackets, future IRMAA income brackets, and even if a Roth IRA conversion will trigger IRMAA.

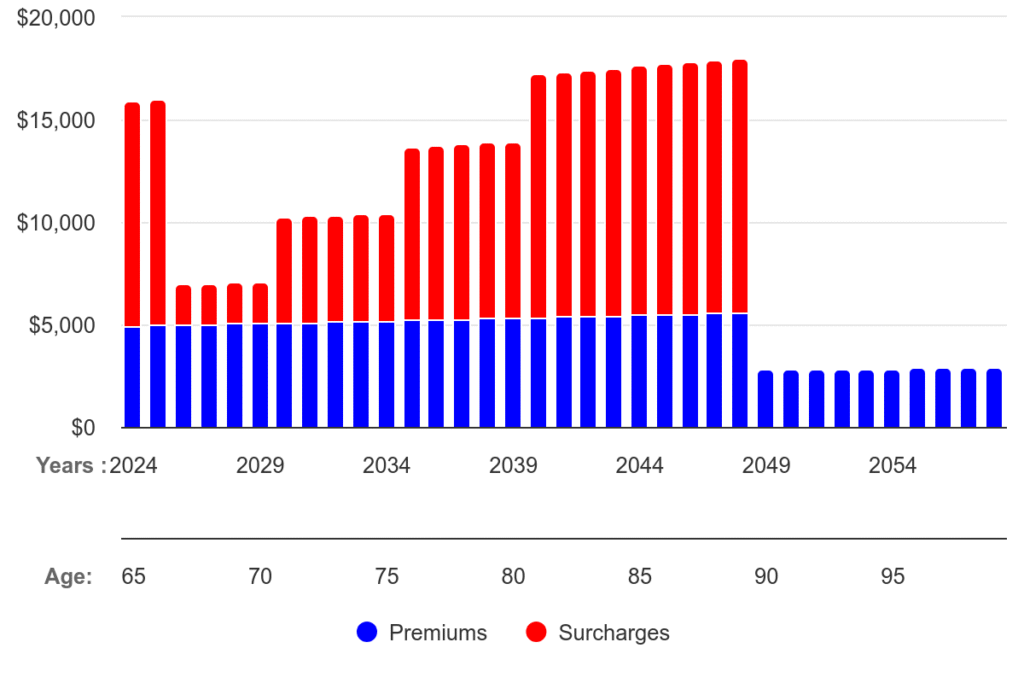

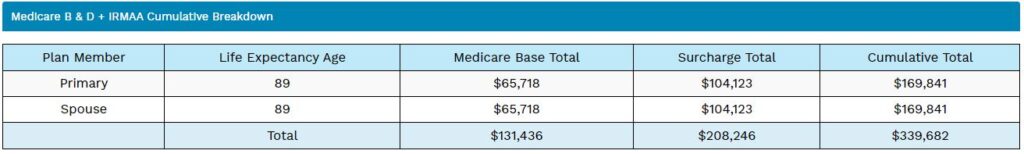

The chart at the bottom of this page is a hypothetical IRMAA for a 60-year-old couple. Notice the IRMAA penalty really accelerating when they turn 77. The total IRMAA penalty over their life expectancy is over $100,000 per spouse!

Hope is not lost!

If you plan ahead, there are several tools you can use to mitigate or even eliminate the IRMAA penalty.

If you want help with your retirement plan including how to plan around IRMAA, click on the following button!

Example 60-Year Old Married Couple (IRMAA penalty starting at age 65)

Summary

Hope is not lost!

If you plan ahead, there are several tools you can use to mitigate or even eliminate the IRMAA penalty.

If you want help with your retirement plan including how to plan around IRMAA, click on the following button!